Foreign Rental Depreciation

The current domestic residential property is depreciated over 27 5 years.

Foreign rental depreciation. Therefore when a u s. Foreign rental property depreciation irs income rules. Foreign rental properties owned by united states citizens are treated the same way as domestic rental properties with the exception of depreciation. Let s also say i will make 1500 depreciation per year i will then end up with 3000.

And foreign rental property that many other countries do not provide is the idea of depreciation. We have rental property abroad and are paying income tax for the rental income to the foreign country. So a foreign rental property bought for 300 000 with annual rental income of 30 000 and allowable annual expenses of 10 000 a further. Also can you confirm that foreign rental property should be using ads depreciation method with mid month convention.

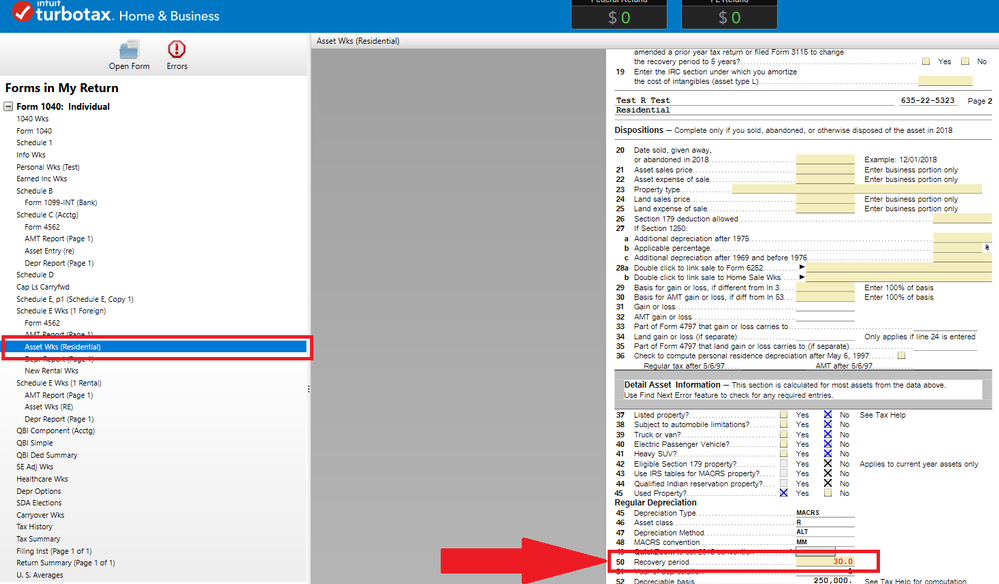

In comparison foreign residential property is depreciated over 30 years. However i am required to also depreciate the rental property over 40 years. We can claim foreign tax credit for that so all good there. The difference is that foreign rental property depreciation is calculated over 30 years rather than the 27 5 used for us property.

Let s say i have 5000 rental income and 500 expenses to deduct. Under irc section 168 g 1 a any tangible property which during the taxable year is used predominantly outside the united states must use the alternative depreciation system as specified. Persons on their worldwide income. The depreciation system of international real estate is stipulated under irc section 168 g 1 a.

The united states is one of the few countries that taxes u s. Lamagno the united states supreme court in a 5 4 decision explained that courts in virtually every english speaking jurisdiction have held by necessity. Tax system provides to both u s. Foreign rental real estate however uses the alternative depreciation system which is calculated slightly differently.

In other words a person can depreciate the value of a property residence when it is being used for rental purposes in order to temporarily reduce the gross income. Depreciation reduces your basis for figuring gain or loss on a later sale or exchange. One benefit that the u s. See which forms to use in chapter 3.

Now that you know for certain the so called experts didn t even get the depreciable life of foreign rental property correct we move back to code section 168 g 1 a. As you may note per irs publication 527 the lower of the fmv or cost basis is used to start depreciating the property. There are some key differences when it comes to domestic and foreign rental property depreciation. You may have to use form 4562 to figure and report your depreciation.

You can deduct depreciation only on the part of your property used for rental purposes. The exchange rate used is dependent on the depreciable base for the property. Individuals with foreign real estate should be aware of the special depreciation rules for foreign real estate. Person has foreign rental income from a property outside of the united states that income is taxable and reportable on a us tax return.