Foreign Rental Depreciation Irs

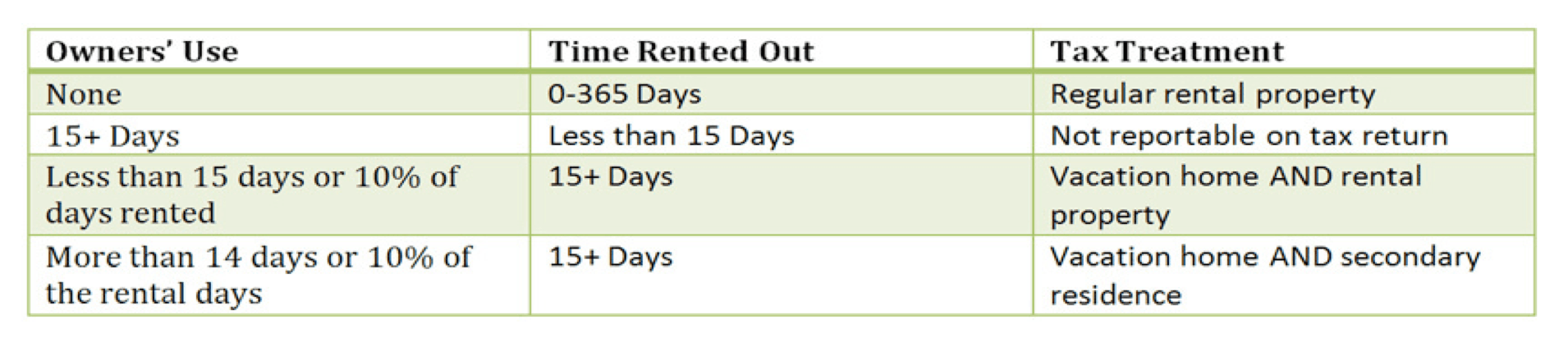

Tax free exchange of rental property occasionally used for personal purposes.

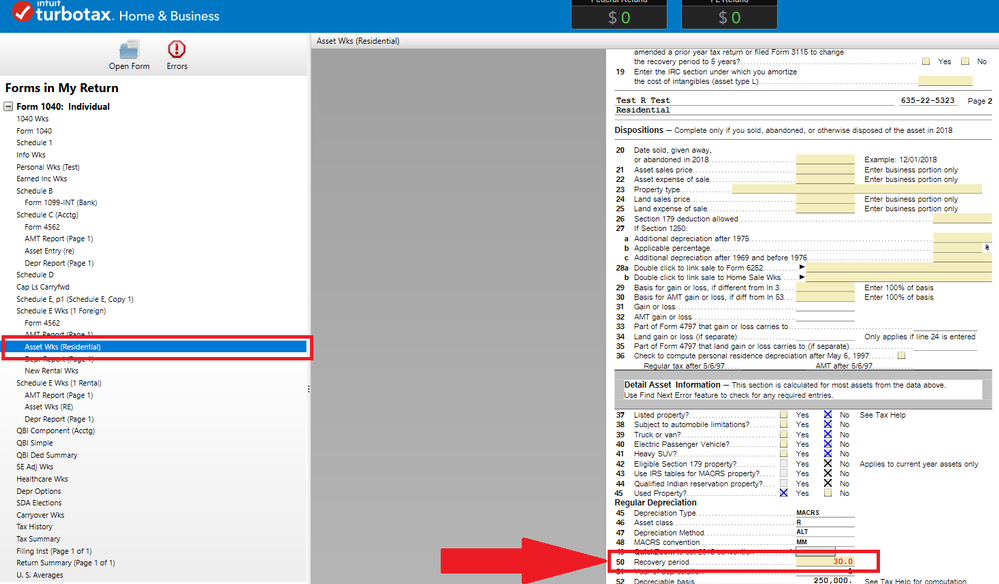

Foreign rental depreciation irs. Depreciation or amortization on any asset on a corporate income tax return other than form 1120 s u s. Let s say i have 5000 rental income and 500 expenses to deduct. Also can you confirm that foreign rental property should be using ads depreciation method with mid month convention. The difference is that foreign rental property depreciation is calculated over 30 years rather than the 27 5 used for us property.

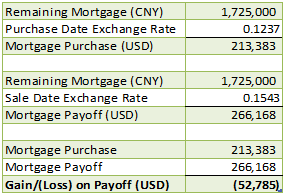

If you meet certain qualifying use standards you may qualify for a tax free exchange a like kind or section 1031 exchange of one piece of rental property you own for a similar piece of rental property even if you have used the rental property for personal purposes. Let s also say i will make 1500 depreciation per year i will then end up with 3000. Foreign rental property depreciation income. The exchange rate used is dependent on the depreciable base for the property.

Income tax return for an s corporation regardless of when it was placed in service. Tax system provides to both u s. However i am required to also depreciate the rental property over 40 years. Foreign rental real estate however uses the alternative depreciation system which is calculated slightly differently.

Therefore when a u s. You must submit a separate form 4562 for each business or activity on your return for which a form 4562 is required. We can claim foreign tax credit for that so all good there. Foreign rental property depreciation irs income rules.

Foreign real estate depreciation example. Person has foreign rental income from a property outside of the united states that income is taxable and reportable on a us tax return. Your foreign rental property cost was 300 000. The depreciation expense deduction each year would then be 10 000.

If you own a home abroad you will likely owe taxes in the country where the property is located. Internal revenue code 168 covers the rules for depreciation including the method period and percentages. Persons on their worldwide income. In other words a person can depreciate the value of a property residence when it is being used for rental purposes in order to temporarily reduce the gross income.

What about double taxation. One benefit that the u s. However bonus depreciation is not applicable to foreign properties. You divide 300 000 by the irs allowed 30 years.

The united states is one of the few countries that taxes u s. So a foreign rental property bought for 300 000 with annual rental income of 30 000 and allowable annual expenses of 10 000 a further. These so called tax professionals are referring to internal revenue code section 168 g 1 a which states in the case of any tangible property which during the taxable year is used predominantly outside the united states the depreciation deduction provided by section 167 a shall be determined under the alternative depreciation system. Individuals with foreign real estate should be aware of the special depreciation rules for foreign real estate.